Shopify Apps for Taxes – Simple Guide to Taxes on Shopify

- Mar-20-2018

- Dilawar Hussain

- 0 comments

Your Shopify store is all setup and running. The initial thrill of setting up your store and watching it go live is exciting. However, there are still a few dreaded tasks left for you to complete, like the tedious collection of sales tax on your Shopify store.

Sales tax can be a pretty complex subject for Shopify store owners. Do I have to pay taxes? How do I calculate sales tax? What are some good Shopify apps for taxes? These are common questions that newbie store owners often have.

Well, worry not because we are going to go through different Shopify apps for taxes that will help you setup and start collecting taxes on your Shopify store.

When Do I Charge Sales Tax?

This question varies greatly depending on the region you reside in, the region you are shipping from, and the types of products you are selling.

For U.S. stores, the type of products that are taxable can be different depending on the states. However, most tangible goods and products are taxable while services are not (in some states).

If the products you sell are taxable within your state, then you need to register and charge your customers for sales tax within the same state.

You can not charge buyers for taxes in other states unless you actually have a significant presence in that customer’s state.

Significance presence varies depending on different states, however, roughly your business will be considered as having significant presence in a state if it meets the following conditions to some extent:

- If you have an office in a state

- If you have a retail store in the state

- If you have an employee in a state

- If you have a storage warehouse in that state

- If you are using a dropshipping supplier from that state

- If you are selling your products at a trade show in a state

For each state you fulfill these conditions in, you need to register for a tax permit and start charging sales tax in that state(s).

For Canadian stores, normally, you must collect taxes on sales made within the same province of your store, and in other provinces. The amount of tax you charge will vary depending on the type of your products as certain items are exempt from sales tax (like certain food products).

Unlike the U.S., almost all of the Canadian provinces require you to collect sales tax whether you have a significant presence in that province or not.

These are just simple guidelines, so you should actually consult a tax advisor regarding sales tax and how they apply to your business and your region.

How to Setup Taxes in Shopify

Shopify includes tax rates for different regions out-of-the-box. You don’t need Shopify apps for taxes, if you want to use the default tax feature in your Shopify admin.

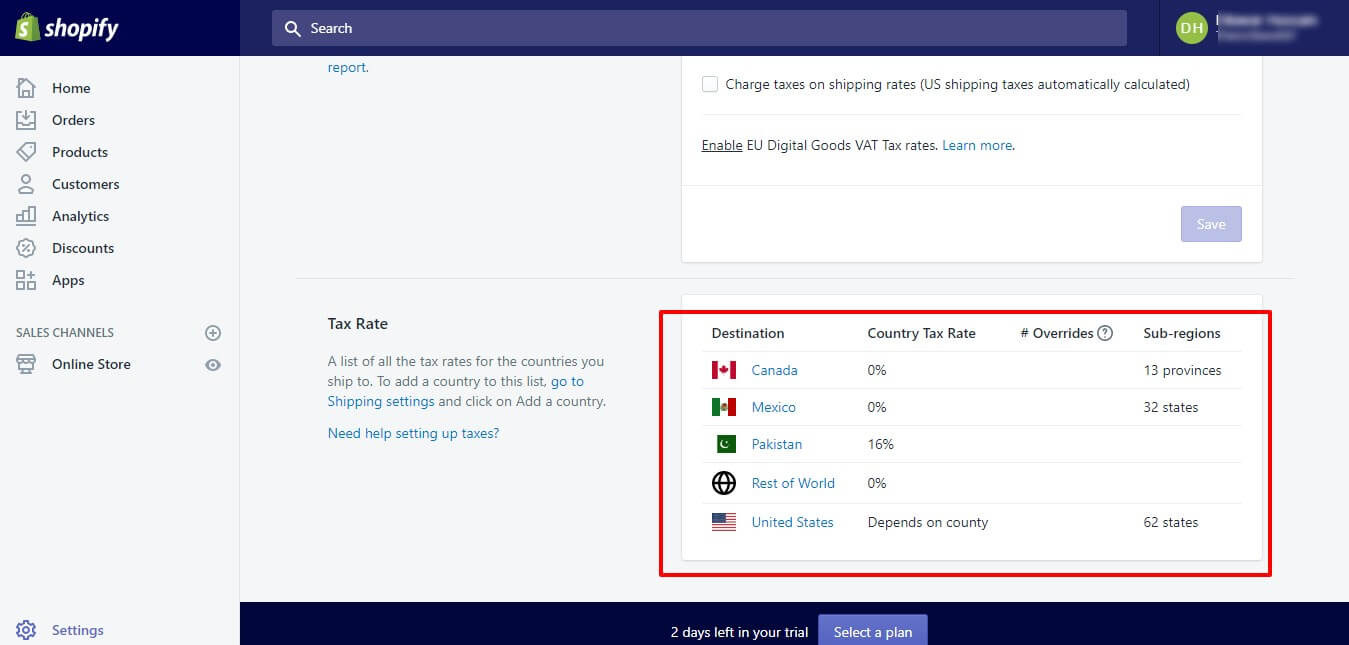

These rates depend on the different shipping zones that you have you set up in your store, and also on the actual location of your company.

For instance, the U.S. Shopify stores that ship to Canada, the tax rate is 0% as default, however, for Canadian stores, the federal tax rate for Canada is 5% as default.

Here’s how you can calculate sales tax for your store on Shopify.

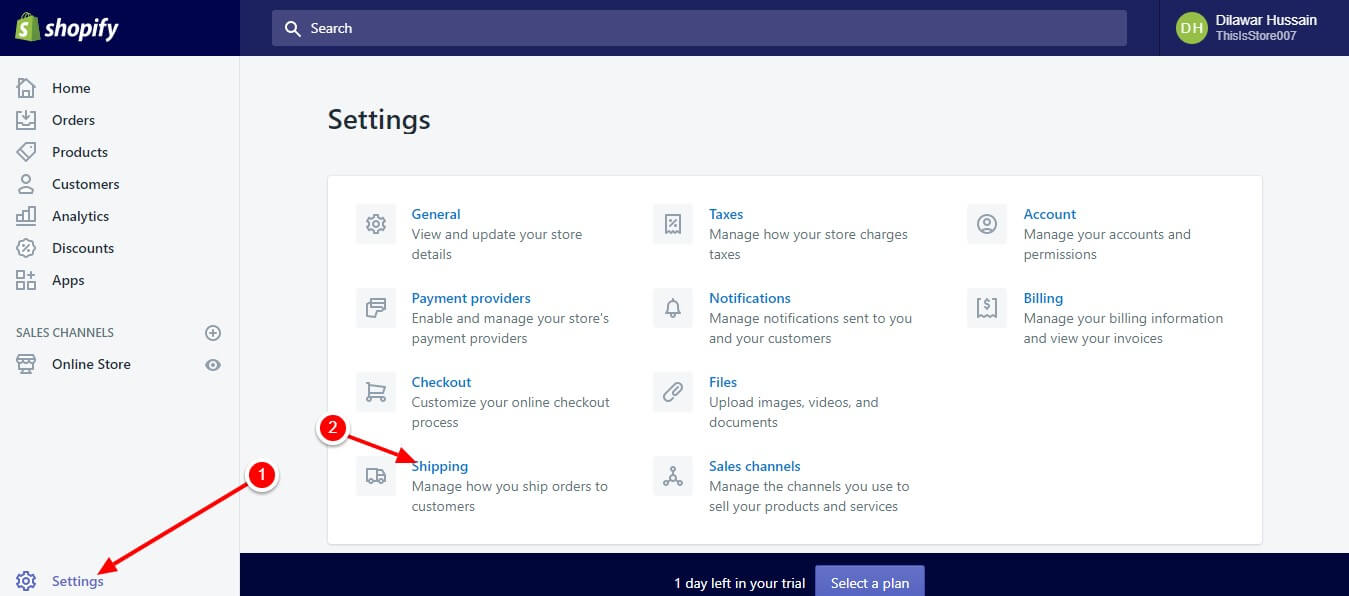

1. Head over to Settings > Shipping in your Shopify admin dashboard.

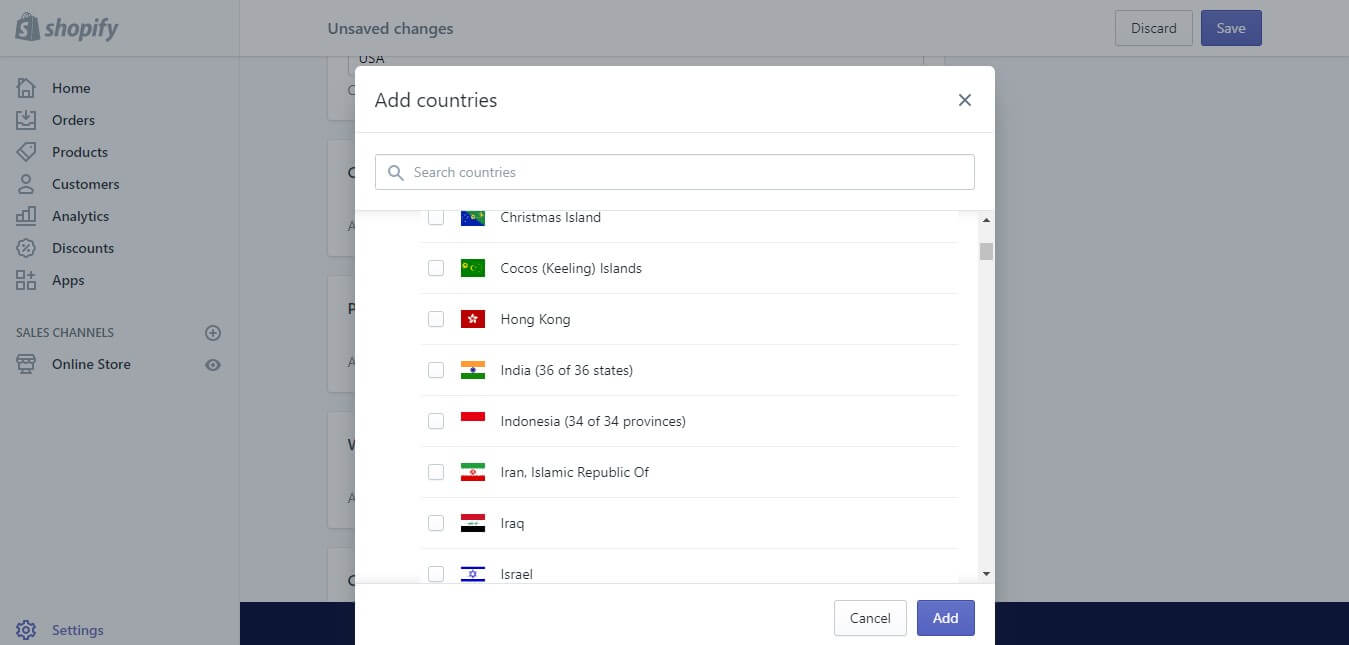

2. Click Add Shipping zone, now you can add one country, whole continent, or the entire world. So, select any countries that you will be shipping to.

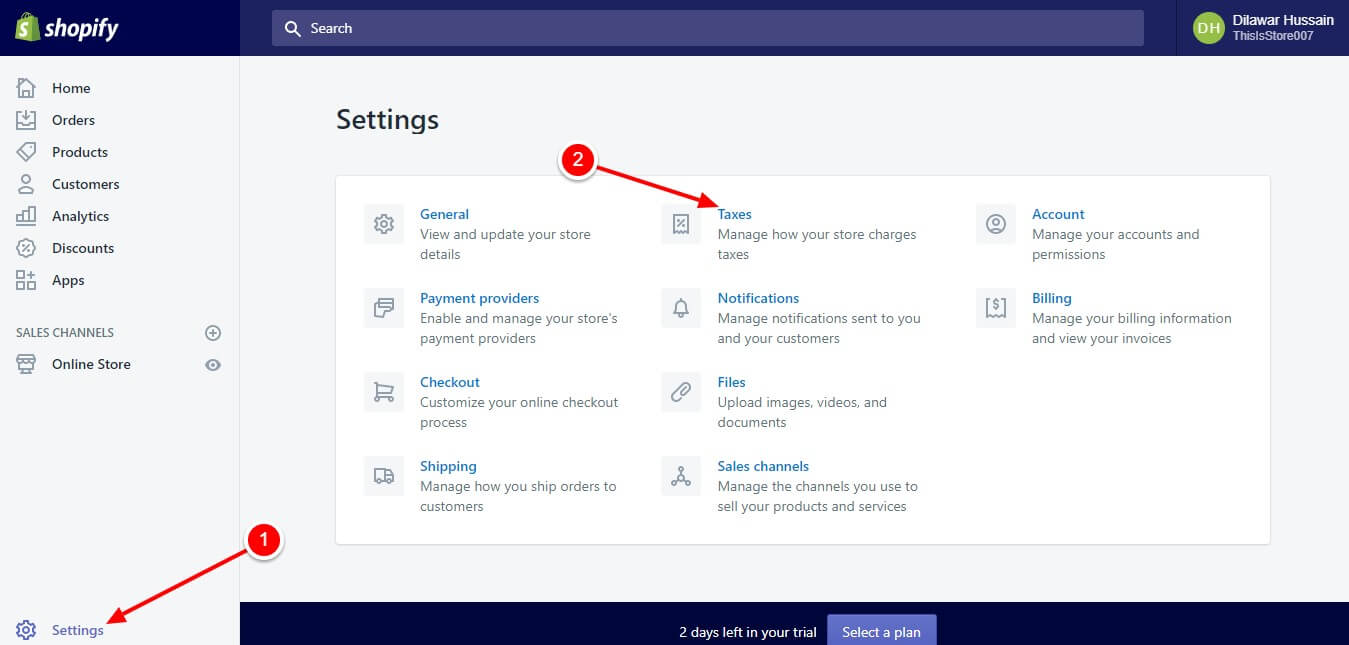

3. Now head over to Settings > Taxes, you will see that Shopify has automatically assigned tax rates to different regions that you ship to.

If you are a Shopify Plus user, you get access to AvaTax by Avalara that lets you automate sales tax information for your Shopify store.

Shopify Apps for Taxes

If you are not on Shopify Plus and don’t have access to AvaTax, you can still use certain tax apps for Shopify.

There are a few Shopify apps for taxes that will help automate and consolidate sales tax information for your store.

Taxjar

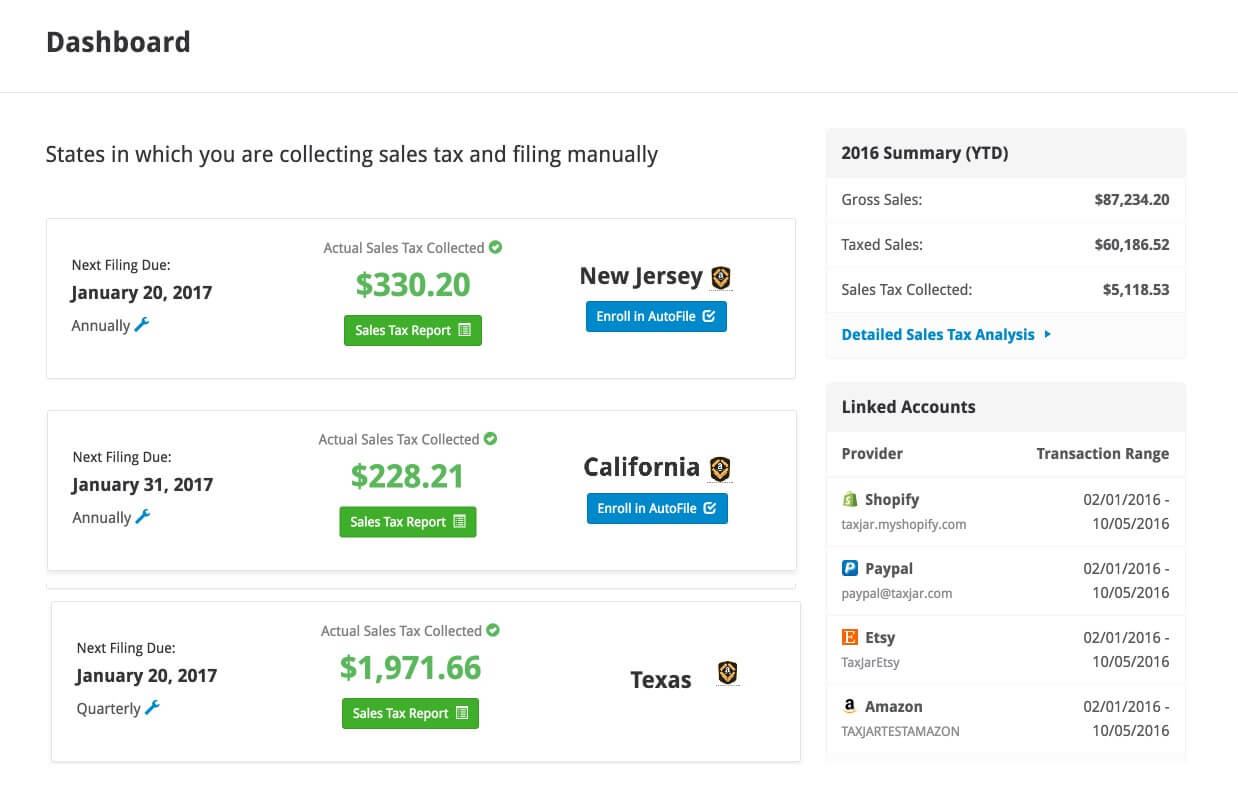

Taxjar is one of the top tax apps for Shopify. It integrates with your Shopify store to automatically prepare reports for sales tax for different states.

This will help you when you are compiling jurisdiction information required to file taxes. This app can also come in handy when you want to automate your tax filing for multiple states and also get an overview of your tax information in one spot.

Taxjar is considered the best Shopify tax reporting app. However, Taxjar currently only supports U.S. Shopify stores.

TaxJar also offers helpful resources and guides like the Sales Tax Guide, and an informational YouTube channel to help newbie store owners with their tax queries.

Taxify

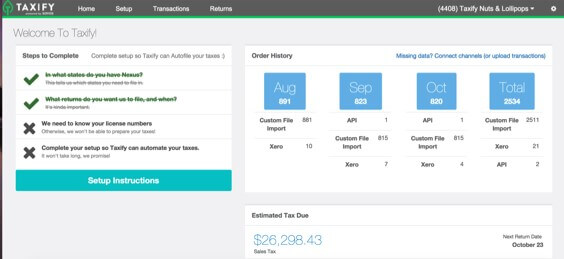

Shopify surely helps you collect sales tax on your orders, but it does not automatically report them to the authorities on your behalf. That you have to do manually, or get Shopify tax app to do just that like Taxify.

Integrate Taxify directly into your Shopify store to automate the entire tax process. It automates the collection of the sales tax and reporting.

By using Taxify, you can avoid audits and late fees with automated tax filing, keep your business protected as regulations and laws change, and reduce hours of manual paperwork.

Similar to Taxjar, Taxify also caters to U.S.-based stores only.

Quaderno

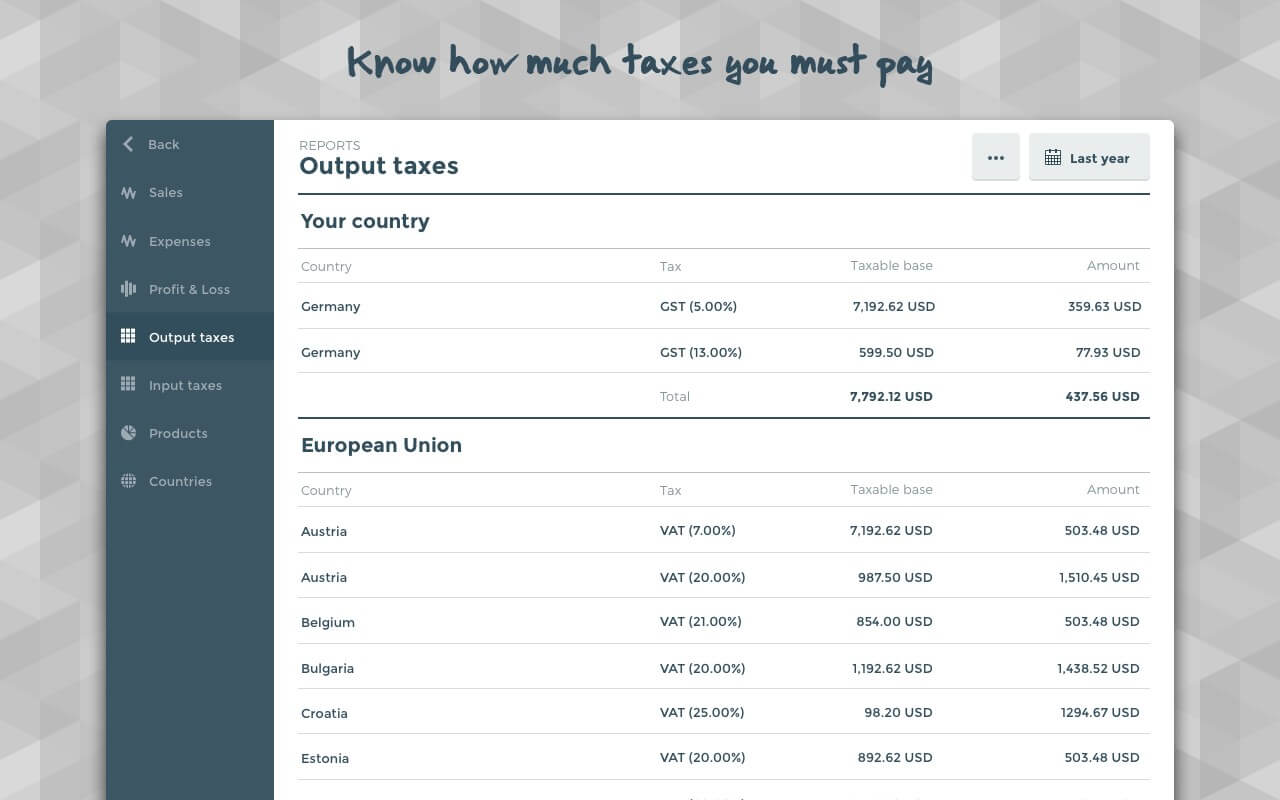

Quaderno is another great app for compiling all your tax information automatically when it’s required for filing purposes.

Quaderno doesn’t provide automatic tax filing, but it does everything else for you. Quaderno makes it very easy to collect sales taxes, VAT, and GST. It helps your business comply with all legal issues, including EU VAT laws for digital items/services.

Every sale you make has the right tax rate applied to it. At the time of paying taxes you can easily generate a standard report to know the exact amount that is due.

In addition to U.S., Quaderno also helps EU-based stores with tax information required for filing.

Final Thoughts

There are certain things that Shopify store owners should keep in mind when it comes to tax laws and regulations.

As already mentioned, you need to charge taxes in states you have significant presence. These includes, but not limited to certain criteria like, having an office in a state, having a warehouse, or an employee in a state, etc.

Shopify does automatically assign tax rates for different shipping regions based on what you set up. However, Shopify apps for taxes will mostly automate the entire process and save you from the hassle of calculating taxes when it’s filing season.

If you have any other things that one should keep in mind regarding taxes then feel free to let us know in the comments below. Also, tell us about your favorite Shopify apps for taxes.

Shopify vs BigCommerce Reviewing the Best eCommerce Solutions 2021

Shopify vs BigCommerce Reviewing the Best eCommerce Solutions 2021  Best Shopify Apps to Boost Sales on Your Online Store

Best Shopify Apps to Boost Sales on Your Online Store  Shopify vs SquareSpace Comparison Review in 2021

Shopify vs SquareSpace Comparison Review in 2021  Shopify Review 2021 – Your One Stop Ecommerce Solution

Shopify Review 2021 – Your One Stop Ecommerce Solution