TaxJar Review – Do Your Taxes With A Single Click

- Apr-30-2018

- Dilawar Hussain

- 0 comments

No one likes Taxes, and no one ever wants to do them, but they are still a necessity for all types of businesses out there.

We’re sure that small and mid-size business owners certainly would instead be promoting their products than crunching numbers to file their sales tax returns.

Today, We’re going to highlight a service/app known as TaxJar which automatically calculates your sales tax and will even file the returns for you.

So, let’s jump right into our TaxJar review to see how this handy service helps business owners manage all their taxes without even lifting a finger at all.

If you still need a refresher on Sales tax and its importance then check out our previous article on Shopify apps for Taxes.

What is TaxJar?

TaxJar is a web-based SaaS (Software as a Service) solution that provides automatic tax calculation and filing features for all types of online businesses.

It helps ecommerce business owners to quickly and comprehensively manage their sales tax and file returns without having to put in a lot of manual effort.

TaxJar is a very reliable solution for everyone who’s running an online business. It helps people who are busy with other important tasks and can’t be bothered with all the nitty-gritty of tax calculation and filing.

It’s designed to automatically calculate sales tax, provide detailed reports, and automatically file tax returns in multiple states.

It lets you focus on other aspects of your ecommerce business while all the tax cycles are automated for you.

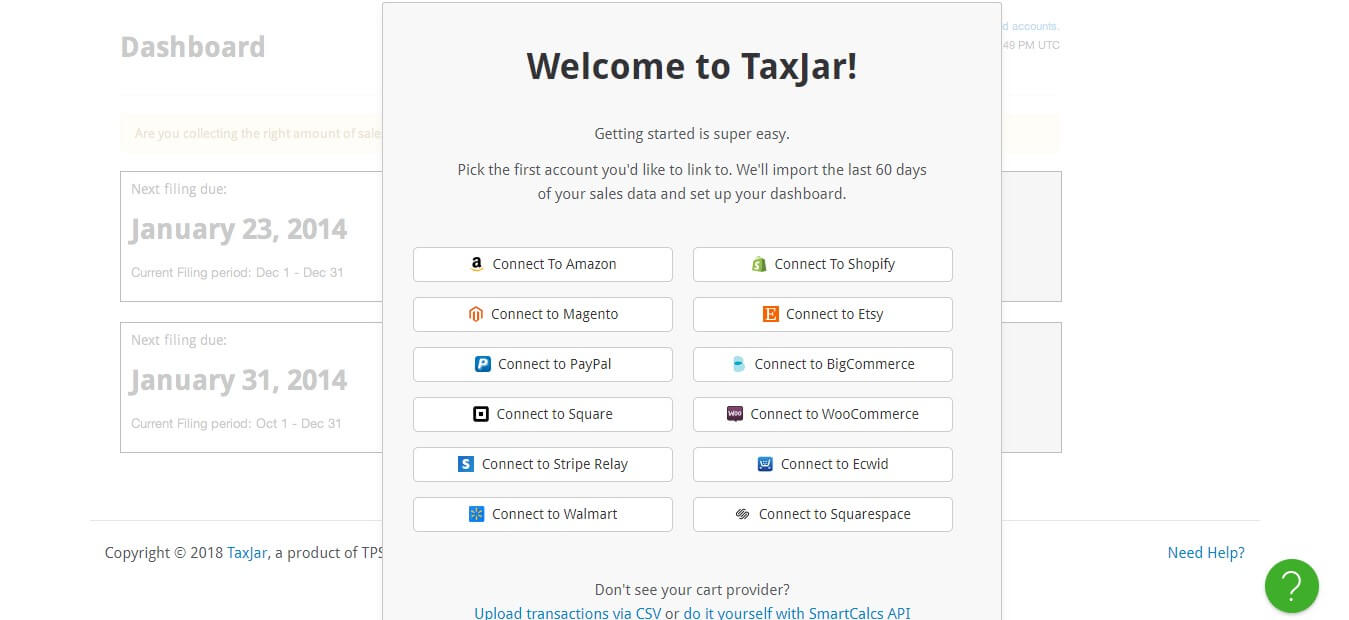

TaxJar allows an easy one-click integration with platforms where you sell. It supports all of the popular platforms like Amazon, Magento, Shopify, Squarespace, Walmart, Stripe, Square, Etsy, etc.

In addition to all that, TaxJar also offers great set of features which include but not limited to, automated synchronization with multiple ecommerce channels and shopping carts, provides return-ready tax reports, multiple platform support, state-level tax reports, supports shipping taxability, detection of over and under tax-collection, and supports SmartCalcs API and import/export of CSV data.

How Does TaxJar Work?

When you install TaxJar on your Shopify store through the app store, it will take you to the TaxJar sign up page.

Just enter an email and password to create your account. Afterwards you will get the option to choose any platforms you want to connect with your TaxJar account.

Choose the platform you want to connect. For Shopify, you will need to enter your Shopify store URL.

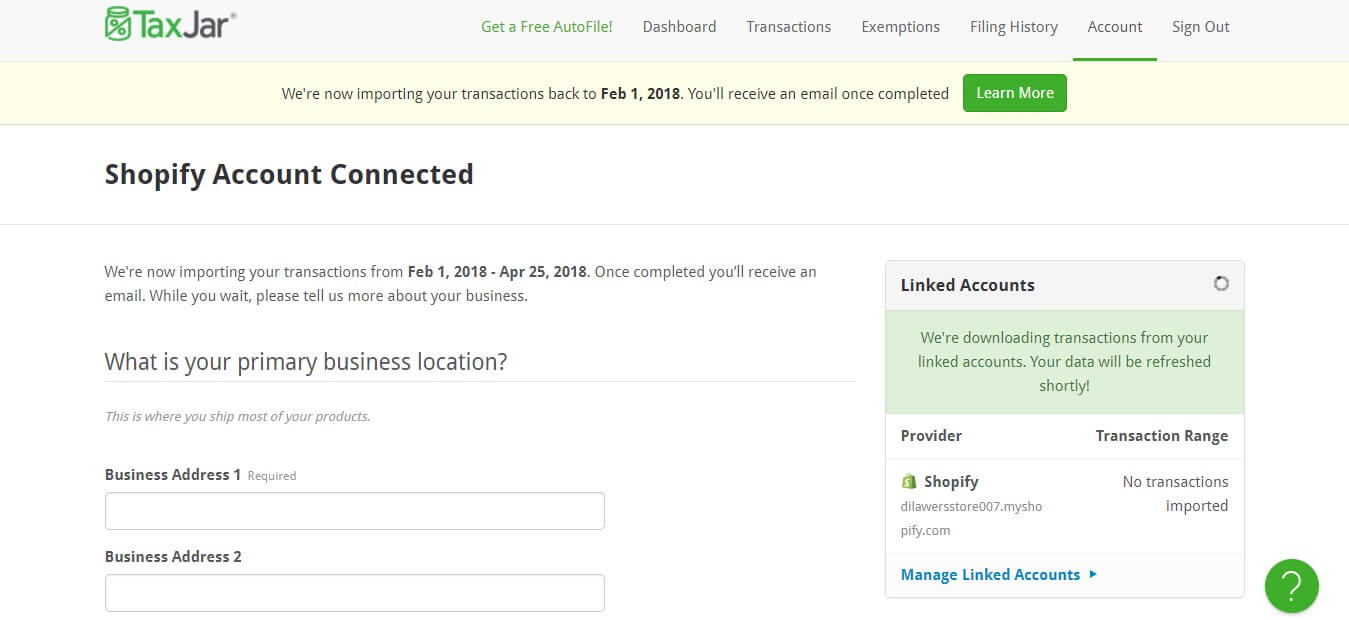

Once connected, it will start importing all your sales data. This may take a while depending, on how many sales you’ve actually made.

You need to add your business address(es) and other details regarding it. It will then pull your sales data.

After pulling all your sales data, it crunches the numbers and provides you with sales tax reports that you can file right away in any state.

It also AutoFiles your tax reports should you choose the Add-on. It can auto file tax returns everywhere in the U.S.

TaxJar Features

Detailed and Accurate Sales Tax Reports: TaxJar’s local jurisdiction sales tax reports show sales tax collected not only for each state but the local jurisdiction (counties, cities, etc.) as well. You can also sort all the data by any date or range.

Estimated Sales Tax Reports: Users see a clear comparison of the amount they collected versus the amount they should have collected.

One-Click Automated Filing: TaxJar automatically files sales tax returns directly to the states. Available in almost every state of the U.S.

Real-Time Collection Data: The app’s dashboard shows how much sales tax has been collected for any state, and when is the next payment due. All the data is automatically updated each day.

Support for Multiple Platforms: Connects to platforms like eBay, PayPal, WooCommerce, Amazon, and more.

Simple Pricing: No initial fees, no setup fees, no contracts. Everyone pays a simple monthly fee that varies depending on the volume of the transactions.

General Ledger and Configurable Accounting Features: It provides a fully electronic interface for repeatable tax filing. Also, provides financial management features.

Customization features: API available for custom integration anywhere you like. If your preferred platform is not available then custom API cn come in handy.

Which Countries Does TaxJar Support?

The AutoFile features is only available for the U.S., but TaxJar still helps you manage and calculate your sales tax, and provides all the required information for the following countries.

Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom.

TaxJar Pricing

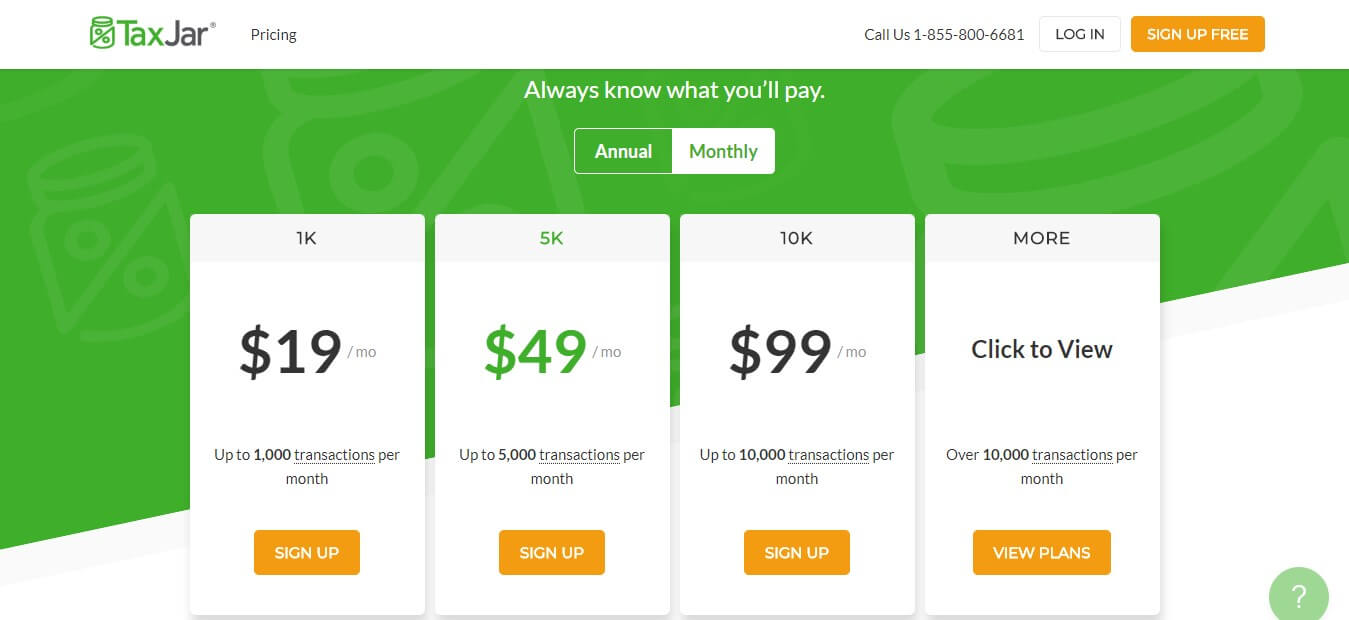

TaxJar offers four small to mid-level plans and one enterprise pricing plan for users to choose from. Here are the details of the plans, and you can choose the most fitting plan for your business:

Basic plan – $19 per month

- Up to 1000 transactions/month

- Auto-sync with multiple ecommerce channels and shopping carts

- Return-ready sales tax reports

- Responsive Customer Support

- Local and State sales tax report

- Supports shipping taxability

- Supports origin-based and destination sales tax sourcing

Plus plan – $49 per month

- Everything in the basic plan plus

- Up to 5000 transactions/month

Premier plan – $99 per month

- Everything in Basic plan plus

- Up to 10,000 transactions/month

Enterprise Plan – By quote

- Everything in Basic plan plus

- Over 10,000 transactions/month

Final Thoughts

Managing and filing tax returns is definitely not a fun process at all, but it’s still a necessary evil that all online business owners have to deal with very often.

This is where TaxJar swoops in and saves the day. It makes sure that you have all the reports regarding how much tax you owe and helps you automate the entire tax filing process.

For small to large businesses, TaxJar provides an accessible, easy to manage and quite robust service to help take the load of sales tax returns off your shoulders.

Whether you are only looking for a little help with your taxes, a one-stop solution to handle all your sales data from multiple platforms, or if you want to reduce the amount of time you waste filing your sales tax returns, TaxJar is the perfect services for you.

Let us know which service do you use for managing taxes for your Shopify store. Comment below.

Don’t forget to subscribe to our newsletter for weekly eCommerce updates!

Free Plus Shipping – How Free Plus Shipping Facebook Ads Work?

Free Plus Shipping – How Free Plus Shipping Facebook Ads Work?  Ordoro Review 2020 – One-stop-shop for all your shipping needs

Ordoro Review 2020 – One-stop-shop for all your shipping needs  How to Setup Shipping on Shopify eStores

How to Setup Shipping on Shopify eStores  How to Setup Shipping for Free Products on Shopify

How to Setup Shipping for Free Products on Shopify