How to Chargeback on PayPal to Get Your Money Back

- Dec-27-2020

- Ameer Rizvi

- 21 comments

PayPal holds immense brand authority for online payments, that is one of the reason that PayPal chargeback has become one of the hottest dilemmas amongst online sellers.

To address this concern we have decided to dedicated this post about ‘ how to chargeback on PayPal ’, or put simply getting a refund for your purchases.

In the sections that follow we discuss ‘what a chargeback is?’ and ‘how to do a chargeback on PayPal?

What is a Chargeback?

The PayPal defines it as “…when a customer files a chargeback with their credit card issuer, it means that they’re disputing a charge and asking the card issuer for a refund.”

Buyers can simply demand refunds for transactions and inform their credit card company to cancel/refund the payment.

These refunds are termed “chargebacks” in banking terms.

In case of the chargeback, PayPal will freeze the funds in the seller account. There are several reasons that can lead to a chargeback:

- The buyer does not receive the product(s)

- A buyer receives damaged or defective item(s)

- Buyer doesn’t recognize/remember the credit card payment

- The buyer receives gets the charge more than once for a transaction

- When a buyer did not authorize the payment

In case of a chargeback on PayPal, the seller incurs a chargeback fee but this fee can be waived (few cases) off if the seller is subscribed to the Seller Protection Policy.

A better way sellers can manage chargeback on PayPal is using breakthrough ecommerce assurance & order verification app. These apps charge a meager amount to guarantee verification of orders and a 100% refund guarantee in case of chargebacks.

How a PayPal Chargeback Works

Generally, when a buyer requests a chargeback, the service immediately contacts the buyer’s credit card issuer. PayPal does not hold any authority during the chargeback process though.

That’s how a chargeback process works with PayPal.

- The buyer requests a chargeback from their credit card issuer for a chargeback. A phone call or email with complete evidence of the transaction is enough.

- The credit card issuer then informs PayPal’s official merchant bank and withdraws the funds from their account.

- PayPal then puts the chargeback funds on hold and deems them untouchable.

- Both buyer & seller are then notified through email. PayPal will request for all information that can help resolve the chargeback.

That’s the basic PayPal chargeback process.

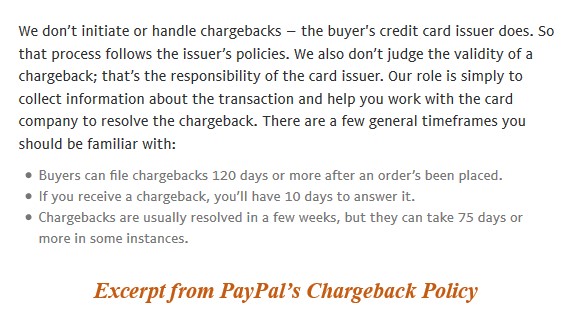

When dealing with chargebacks, some points you need to remember:

- Buyers are eligible for chargebacks on PayPal transactions for 120 days or more after placing the order.

- Sellers who receive chargebacks have a 10 day time period to respond to the dispute.

- Chargebacks on PayPal usually take a matter of weeks but can take up to 75 day or more depending on the case.

How can Sellers manage chargeback on PayPal

Usually, PayPal sides with the buyer providing them a complete refund while the seller is left hanging. You can always get PayPal’s seller protection, but the feature comes with its own rules & restrictions leading sellers nowhere.

Signifyd, is a leading solution available on the Shopify app store designed specifically to support sellers in case of chargebacks. Signifyd’s eCommerce assurance features allow sellers to mitigate against growing eCommerce challenges.

Can You Use Paypal on Aliexpress?

Signifyd provides sellers some brilliant features that:

- Automatically assess order reliability & validity

Signifyd automatically assesses all transactions and verifies if orders are to be completed or not. All orders are secure with chargeback protection to ensure the seller does not experience massive losses.

- Provide auto fraud prevention

The zero fraud prevention feature guarantees all your transactions. In case of fraud as PayPal chargeback, Signifyd app offers the seller a brilliant verification system that ensures no fraudulent transactions can go through. Refund payments are made within 48 hours to sellers.

- Provide fraud liability insurance

The liability insurance as mentioned above covers 100% of refund & chargeback costs. In case a fraud transaction is ever accepted, Signifyd covers the cost of the sale and the chargeback fees.

- Automatic Order Approval/Rejection

The leading edge Signifyd console lets you manage orders automatically removing the hectic tasks. Signifyd will automatically send verified orders for processing while rejected orders are left out.

To learn more about Signifyd, check out this page.

How Do I Prevent PayPal Chargeback Scams?

Among other types of scams that a buyer can commit include:

- Claims that products were not delivered, when actually they have.

- When a buyer claims products were defective, but actually they were fine.

- Disputing the quality of the products or services.

- Claims that the transaction was not authorized by them.

The absence of proper eCommerce chargeback laws are the primary reason many of these buyer scams are a success. The developments in eCommerce have led to great ease but also encouraged scams from different parts of the world.

You can take several steps to ensure your shop is not hit by scams:

- Never ship to a freight company, always ship to the buyer’s home address

- Verify buyer IP Address. Then verify if billing & shipping address complies with, the IP and location

- Use a customer & order verification tool that identifies fraudulent buyers. E.g. No Fraud app on Shopify

- Be sure your store complies with all FTC Regulations

- Create accurate and easy product descriptions, so there is no objection later from buyers

- Be very clear about product quality & features, don’t forget to mention anything

- Be in contact with the customer 24/7 over phone, email or WhatsApp

- Publish your contact information on the webstore

- Always consider having PayPal Seller Protection – it may not be perfect but still a great way to protect against scams

- Always check the email address that sent you the PayPal chargeback notice. Sometimes scammers create fake PayPal related emails to send out scams. (see example below)

Differences between Chargebacks and PayPal Disputes

Since we already know what a chargeback is, let’s quickly overview of PayPal Chargeback vs PayPal Dispute.

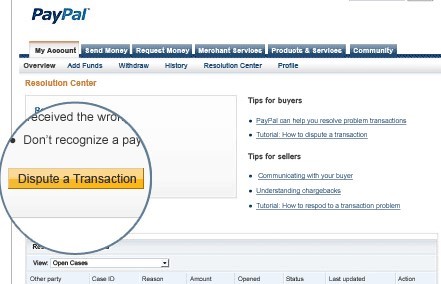

In case the buyer & seller fail to agree terms, the buyer can launch a dispute through their dashboard. PayPal freezes the funds till both parties reach a resolution.

The buyer & seller are required to negotiate from this point on, in case the two parties fail to agree PayPal moderation gets involved to resolve the issue and this is then called an “escalated claim”.

Parties Involved

The first difference is of the parties involved. Chargebacks on PayPal involve the buyer and their credit card issuer.

In case of a dispute PP administration keeps the issue in house to get it resolved between buyer & seller.

Account Suspensions

In case of chargebacks on PayPal, the buyer cannot conduct transactions and their account goes into “suspended” status.

In disputes, only the amount for that disputed transaction remains on hold, the buyer’s account remains active for other transactions.

Decision Making

The credit card company holds authority and makes the decision in a chargeback.

In a dispute, first buyer & seller can reach an agreement without escalation. If both parties don’t agree, PP moderators steps in and offers a resolution best for both.

Resolution Times

A chargeback can take up to a minimum of 6 weeks to arrive at a result.

A dispute takes no longer than a month, with both buyer and seller required to act quickly.

Other Types of Objection on PayPal

The objection means any unwanted event happened in PayPal transaction. The Buyer, seller or even the bank could initiate the objection.

Generally, three types of objection occurred on PayPal,

Dispute

Buyer initiates the dispute when the problem with the transaction occurred.

Reasons for Dispute

The dispute can occur for two reasons:

- Item Not Received (INR): In this case, buyer claims of not receiving the order after the payment.

- Significantly Not As Described (SNAD): In this case, buyer claims the product is not up to the expectation as described by the seller or product is different.

The complaint is through PayPal’s resolution center however, PayPal would not involve in the scene of dispute. Seller will receive an email where he can directly contact the customer to resolve the dispute.

Claim

Claim is an advanced version of dispute when the disputes is not resolved in 20 days and buyer escalates the issue to PayPal.

Another reason for the claim is ‘Unauthorized Transaction’. It means the buyer’s account may have been compromised or hacked and someone made a purchase from the account without their permission.

In the claim, the seller has 10 days to respond. If the seller does not resolve it in the given time, PayPal will close the claim in favor of the buyer.

If sellers respond within 10 days, PayPal will evaluate the claim and resolves the case within 30 days. However, in complex cases, it could take a long time.

Bank Reversal

It happens when the buyer or the bank request to refund the transaction made by the bank account.

The Reasons for Bank Reversal:

Bank reversal usually happens when someone uses the buyer’s account information without their consent. The situation in which bank reversal happens,

- The buyer’s bank account was used to purchase an item without their permission.

- Buyer identity unknown transaction.

- When the purchased item did not arrive.

- The buyer was charged twice for the same item.

PayPal Chargeback – Frequently Asked Questions

how to get a refund on PayPal if scammed?

For a buyer, getting money from PayPal, after being scammed, process is very easy and can be done by reporting a dispute with PayPal using their dashboard. Decisions usually take 5 to 10 days and are mostly ruled in favor of the buyer. PayPal will return money to the buyer after an investigation.

For sellers, it is tough to get a refund. PayPal is not an ideal method to use without its Seller Protection service, but even in the case of the protection, some cases are ruled in the buyer’s favor. As a recommendation, sellers should keep all evidence of the transaction and sale, keep track of shipping and delivery, and have a solicitor just in case a large amount is involved. There are no types of PayPal chargeback fees.

Can PayPal Payments be Reversed?

Yes, the PayPal payment can be reversed when a chargeback occurred. The buyer has the authority to ask their credit card provider to reverse the payment that has been made through PayPal account.

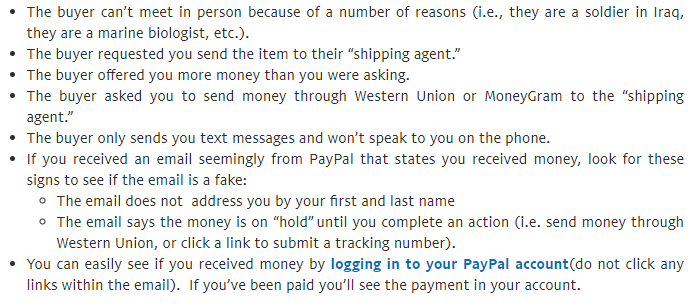

Is PayPal safe for sellers on Craigslist?

Sending and receiving payments on PayPal are safe most of the time. Nonetheless, on these websites, there is higher for you to come across with a scammer who would promise to make payment via PayPal but does not follow through it. To identify the Craigslist scam here are some points PayPal mentioned for your guideline.

If you come across any of these conversations just back off, it is a scam.

How to get money back from PayPal friends and family dispute?

There no guarantee of getting a refund from PayPal friends and family dispute. Because there is no buyer’s protection option available if you transfer money as a friend.

So, avoid transfer money to anyone as a friend or family if you do not know the receiver.

Can you get scammed by using PayPal?

There have been cases occurred in the past where some scammer hacked someone’s PayPal account. You have to be sharp to identify forged email or any uncertain activity on PayPal account. PayPal usually reimbursed the payment if you could confirm about being scammed or hacked.

How do I link a debit or credit card to my PayPal account?

You can link your debit/credit card to your account as follows:

- Sign into your account

- Click the Wallet button on top of your dashboard page

- Click + Link a card or Bank

- Next, click Link a Debit or Credit Card

- Fill the provided boxes with your card details

What is the PayPal chargeback time limit?

A buyer can file a chargeback 120 days or more after making the purchase. A Seller has 10 days to respond to a chargeback. Usually, chargebacks take up to a few weeks to process. Depending on the complexity of the case some chargebacks can take 75 days or more to process.

What happens to the Seller PayPal Dispute?

In the case of a chargeback, no accounts get freezes or puts on hold, the buyer and seller are requested to come an agreement. If that doesn’t happen, then the PayPal dispute resolution comes to resolve the issue and moves the dispute to claim.

Can I cancel a payment on PayPal?

Recurring payments are canceled through your dashboard, but, one time payments cannot be canceled and must go through the dispute process or chargeback.

How to chargeback on PayPal debit card?

You can get chargebacks on PayPal debit card like any other credit/debit card by demanding a refund from the bank. The amount should take 3-5 days to come back to your account.

How does PayPal Work for Sellers

PayPal was a payment gateway primarily designed to help buyers make secure payments for online purchases. The service has never really been an ideal method for sellers. This is largely due to the lack of protections available for sellers. PayPal does, however, accept payments in 25 different currencies from 200+ countries around the world.

Types of Seller Accounts

PayPal allows sellers to receive and send out payments through all of its 3 account types namely basic, premium, and business.

A basic account allows receiving payments but only allows withdrawals of $500 per month. When a bank account is connected to the PayPal account, it is then classified premium and removes the withdrawal limit. A business account is more or less the same as a premium account, it provides the facility for multiple users to access the account.

PayPal Seller Account Fees

Sellers with registered businesses on PayPal also pay a 2.9% fee + $0.30 for every sale transaction. E-store owners who are not using Shopify or an eCommerce platform can embed PayPal for $5 a month. E-Store owners can also make use of the PayPal Payments Pro service which basically allows sellers to accept credit card payment over the phone.

Receiving Payments

When a buyer pays for purchases payments can take upto 5 days to appear in the seller’s account. Usually, if the payment is made by a buyer account linked to a bank, card, or current PayPal balance it is immediately sent to the seller, who can then dispatch the goods. In case of an eCheck payment, the payments usually clear between 5 and 7 days.

Seller Protection

PayPal offers sellers protection from fraudulent buyers through the Seller Protection feature. The process is quite simple:

- Sellers only ship items to a PayPal authorized address for the buyers

- PayPal registers authorized buyer addresses beforehand

- Authorized addresses are verified through bank account or credit card information

- Sellers are recommended to provide a tracking number as poof of delivery

In adding to the points as mentioned earlier, there are several other conditions to meet to qualify for a Seller Protection payment. The first of these is that if an order is above $250, sellers need to provide a signature for authentication. This is followed by the principle that goods must be shipped within 7 days of the order. Once all these terms have been met, PayPal guarantees payment for shipment and the product(s).

In a Nutshell

PayPal remains one of the most popular payment processors for online transactions. Buyers unaware about refunds and disputes will definitely love learning about making chargebacks on PayPal transactions. Remember to share my article and leave your feedback to improve my content accordingly. Subscribe to our mailing lists to get the latest Ecommerce tips, hack and strategies for a prosperous business experience.

What to Sell on Etsy –12 Best Selling Items on Etsy in 2021

What to Sell on Etsy –12 Best Selling Items on Etsy in 2021  11 Easy Ways to Make Money on Amazon in 2021

11 Easy Ways to Make Money on Amazon in 2021  eBay Dropshipping – Learn Dropshipping on eBay in 5 Steps

eBay Dropshipping – Learn Dropshipping on eBay in 5 Steps  41 Best Dropshipping Suppliers for Your Business (Niche Based)

41 Best Dropshipping Suppliers for Your Business (Niche Based)

Nice tips, I love the article. Requesting for a chargeback on Paypal is not the same as filing a dispute with PayPal. Since the process will be on a third-party domain (the card issuer) the process will be based on the card issuer’s terms. But requesting a chargeback is not enough. You will also have to have all the supporting documents and information to support your claim. If you lack one vital proof about your claim, you will eventually lose your case. And ultimately, you will lose that amount of money.

One wouldn’t really think much of this, all I really wanted to do was invest and be part of it but the way I was misled by this brokers was terrible, to easily take money from all in the name of investment and when I wanted to make withdrawals every single attempt was fruitless with constant hassle to invest more I really can’t say more than I have already said. I would really consider myself to be one of the very few lucky ones as I was able to have my funds recovered from this scam Binary option brokers, although it was through unethical means as far I am concerned but what can I care after how my hard-earned funds where taken from me, these guys are the best in less than 7days all my funds including bonuses had been recovered, If your broker lost your funds trading Binary options or any other online fraud, wealthrecovery94 at geemail

dot com are more than able to get your funds back without any traces. Best of luck people.

Will paypal automatically deduct money from bank account incase of chargeback from buyer on the same day the chargeback was made..

I am a buyer who got scammed, seller shows solid proofs against my disputes in paypal and my cases were closed in favors of the seller. Due to its a fraud case, the bank closed my chargeback case. Is there any other way I could get back the money ?

That’s a nice article. Totally loved all the information you provided. However, as a seller, I want to know how to get money back from PayPal if scammed by the buyer? Is there any way to do this?

You can not get your money back easily as a seller. As a buyer all you have to do is dispute the charge and you will get the money back, but as a seller, you need to keep track of all the information, emails, messages, etc. that you have related to the transaction. You can then use these to your advantage and as an evidence. This can often help you get your money back from PayPal.

Why does PayPal always side with the buyer in the case of a chargeback? Why are sellers never given any favor at all? Is PayPal biased or something?

It’s PayPal’s policy to protect the buyer at all costs. Buyer protection program offered by PayPal heavily favors the buyers in case of a dispute. They also help the sellers out, but the sellers have to prove everything with authentic documents, screenshots, etc. All Buyers have to do is hit dispute and file a chargeback to get their money back almost instantly.

I am a new seller utilizing PayPal for payments. Is there a way I can avoid getting fake Chargebacks?

It’s a great idea to keep a complete track of all the information, emails, messages, etc. if you suspect someone might do a chargeback scam. Here are some of the details you should keep at hand.

– The tracking number.

– Date, the buyer, received the item.

– Take pictures of the UPC and the shipping slip together.

– A screenshot showing the packing slip matching the PayPal confirmed address.

This way you can be proactive. As soon as you are charged back, you can just fill the form for PayPal’s seller protection program and provide all the information.

If you do fall victim to a scam consult immediately with a chargeback firm to see if you can get your money back from your credit card company. It’s a complicated process that gave me a lot of headaches but the chargeback consultants like the one I used (Mychargeback) are quite knowledgeable and know what they’re doing. They hold your hand the whole way.

After working for a client for months and finally getting paid, I was hit with a massive $10,000 chargeback through PayPal. He decided to steal all the money and I was stuck dealing with PayPal. How should I get the money back? I am in Australia and the guy I was working for in the US.

That’s very low of your client to cheat you like that. Generally, when a buyer requests a chargeback, the service immediately contacts the credit card issuer, which then withdraws the funds. The only option you have is to sue the person in US court.

However, it is imperative that you have a representative in the US. If you have a family member, that’s even better. Otherwise, you can hire any local lawyer in Australia to see what other options you have. Hope you get your money back!

Hi, I sold digital keys for two PC games a month ago over eBay, physical postage was done. The buyer paid through PayPal then 20 days later claimed a chargeback on PayPal for $99. The buyer claims the account was hacked and I don’t wish to pay back now that I delivered the key code to them, and I have proof of delivery.

I did contact PayPal provided them with the case, proof of delivery and the positive feedback of the buyer. Anything else I can do to avoid chargeback?

Hi Addison Liam, this looks much like a definite case of scam where the buyer uses the digital code and certainly doesn’t want to return it. eBay strictly disallows selling digital items on the platform for this particular reason.

What I do understand here is that digital goods are not covered in the eBay Buyer Protection policy. So, this technically means the buyer cannot claim a refund for goods not allowed & covered by eBay. The company will take no responsibility that the goods were purchased over their platform. You will not be bound to refund the amount to the buyer, and the chargeback will be refused.

Since you have proof of postage, you have nothing to worry about. Although eBay and PayPal both mostly rule in favor of the buyer, this case completely highlights you as a victim of scam. You will hopefully win the dispute and will not have to refund anything.

Hi I sold a virtual product through PayPal and used the tag Friends & Family for the transaction. The buyer paid me through their PayPal balance, there was no fee charged, but later the buyer cancelled the payment and now it is held by PayPal. I have already sold the item and transferred to the buyer, will I get a PayPal chargeback?

When using the Friends and Family option in PayPal the service does not charge any additional fees from users. Several sellers in the past have tried this method within the USA to receive payments for good sold, without incurring any fees and commissions from PayPal. It is not recommended by PayPal since it doesn’t offer any Seller Protection in case of fraud.

Yes, either way if the buyer makes a PayPal Chargeback or they are a fraud, you lose the money. You didn’t use the proper method of receiving payment and have no seller protection. PayPal will only intervene when you create a dispute and then will ask for evidence of the transaction.

Hi

I made a big sale to a US buyer worth close to $1000, I am running my dropshipping business from Australia by the way. I indicated that delivery time will be between 4 & 6 weeks, but, the buyer made a chargeback and PayPal disputes judged in his favor. Now I have lost money on the products which have shipped and never received the payment.

Now that I know I have been scammed, how should I pursue this with PayPal? Do I need a lawyer to handle this?

Hi

I made a big sale to a US buyer worth close to $1000, I am running my dropshipping business from Australia by the way. I indicated that delivery time will be between 4 & 6 weeks, but, the buyer made a chargeback and PayPal disputes judged in his favor. Now I have lost money on the products which have shipped and never received the payment.

Now that I know I have been scammed, how should I pursue this with PayPal? Do I need a lawyer to handle this?

Answer – Hi, thanks for reaching out to us, I know the dispute process is highly inclined towards buyers and doesn’t consider the sellers request even in case it’s a scam. For your case I will suggest contract a lawyer who has contacts in the USA. They will pursue the case for you, but remember it involves more fees and retainers.

The most you can do to avoid such issues in the future, is to get the PayPal Seller Protection. Seller Protection evaluates buyers and informs you if a certain buyer is not reliable.

My honest suggestion as a drop-shipping store owner, remove PayPal from your e-store and consider using Stripe or just pay a little more free with credit card transactions directly. I really don’t consider PayPal a useful payment gateway for sellers, it has no real inclination to help sellers either.

Hi

I just launched my e-store on shopify, so its that easy for people to get a chargeback? how am I supposed to make any sales if money will be taken from me? what are my alternatives? i read payapl payment protection and that is completely useless for me too

Hi Geoffrey

As alternatives, Shopify provides Stripe as its recommended payment method. DO remember it comes with several packages and it will charge you for making transactions. They have pay as you go and enterprise plans so you can decide which one to go for, the pay as you go plan charges 2.5% for payments. You can also try credit card payments through shopify but that also charges fee for transactions. The only way to ensure sales is by carrying cash on delivery for a while.

It is quite easy for PayPal buyers to create disputes, and they usually go in their favor. Sellers can only get Seller Protection which doesnt end well for them.