13 Best PayPal Alternatives to Use in 2021

- Dec-24-2020

- Bilal Uddin

- 0 comments

PayPal is the uncrowned king of online payment providers; having a market share of 59.69% with over 277 million active users onboard.

However, the grass is greener on the other side.

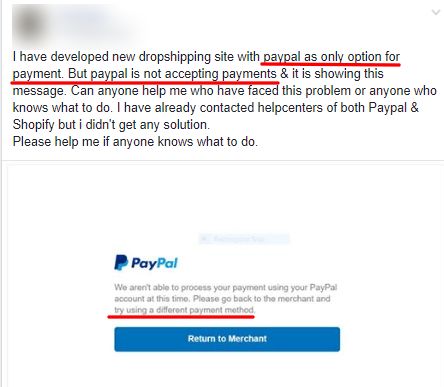

Not everyone is blessed to get the maximum benefits from this platform.

Some belong to places where it is prohibited to use PayPal while some fail to understand the complexity of PayPal and ended up getting banned.

Well, there is a treat for everyone, those who cannot use or do not want to use PayPal still have numerous and great PayPal alternatives to use that open the global payments gates.

In this post, I tried to cover the best PayPal alternatives for users of different needs. By the end of this post, you will definitely be able to select the best PayPal alternatives for your need.

13 Best PayPal Alternatives of 2021

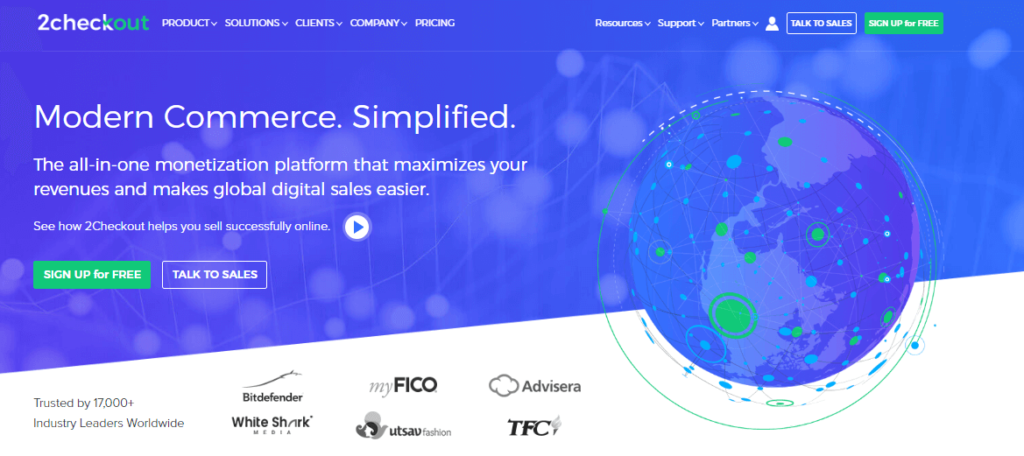

1. 2CheckOut

2CheckOut is a great payment option for international payments. It allows the user to receive payments from credit/debit card, PayPal and 45 other payment methods by syncing the account of the merchant with payment gateways.

If offers its services in 200+ foreign markets in 15 different languages along with 87 currency options.

Apart from that, it also offers several useful tools to optimize the business functions such as recurring billing, sales reports and synchronization with different shopping carts.

The process of 300 fraud checks in a single transaction secures the payment.

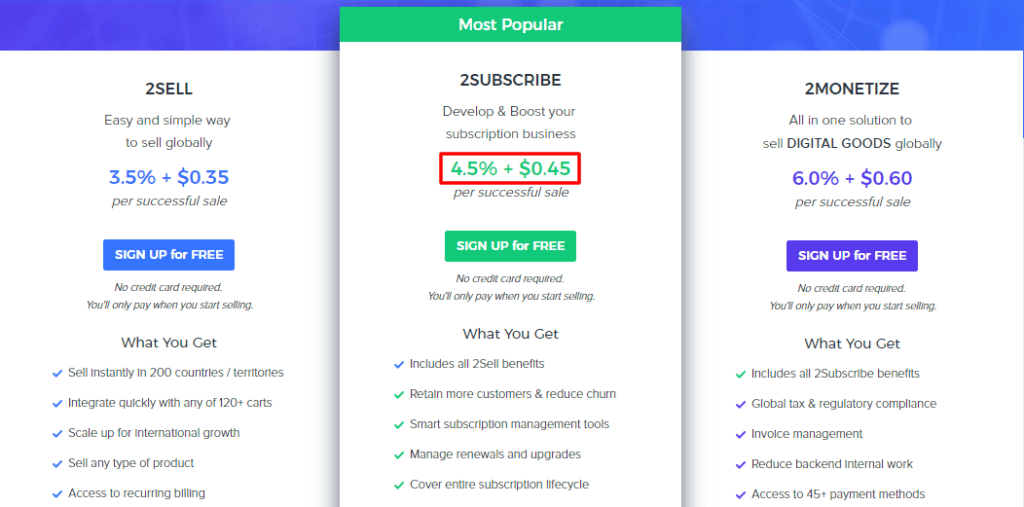

2Checkout Pricing:

2CheckOut most popular plan comes at 4.5% + $0.45 per sales.

The fees are the same for everyone, however, in some specific regions, there are an additional 2% charges to accept payment beyond the borders. (Get more details of 2Checkout here)

2. Skrill

Skrill is very similar to PayPal and much more comprehensive that makes it one of the best PayPal alternatives.

You need to link your bank account to Skrill then you can receive and send money with email and password.

It also offers a prepaid debit card so you can instantly receive the payment on the debit card that you can use to withdraw cash from ATM.

Skrill contains multiple fraud protection tools that similarly work as PayPal that freezes user accounts on any inappropriate activity.

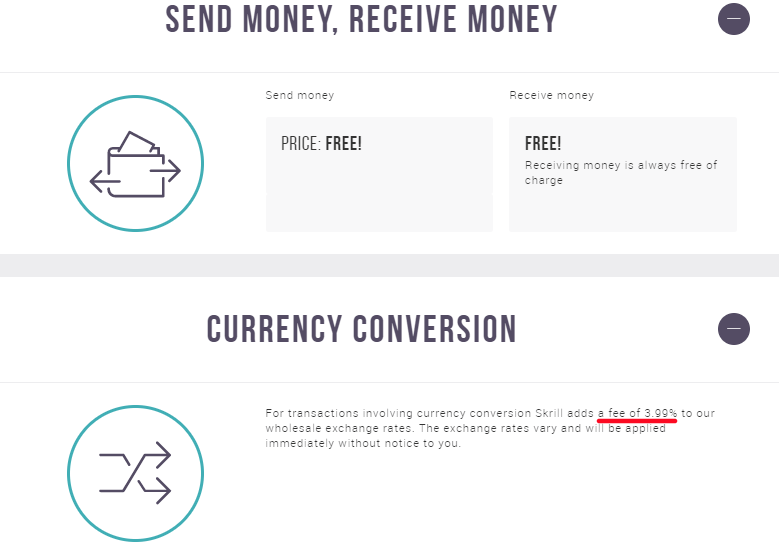

Skrill Pricing:

It is completely free to send and receive money from Skrill. However, it charges a fee of 3.99% for currency conversion. (Check out pricing details here)

3. Payoneer

Payoneer is the most preferred PayPal alternative that completes a payment within 2 hours. You can send and receive money via debit card, credit card, and ACH payments.

It is particularly preferred among small businesses. It focuses on ecommerce, online advertisement, and freelance sector.

It also offers a debit card that can link to the Payoneer that allows you to withdraw your money from anywhere worldwide.

Payoneer Pricing:

Transactions between Payoneer users are free; there are 3% fees for credit card transactions and 1% for eChecks payments. Check out the pricing here.

4. Dwolla

If you are dealing with numbers of bank transfers then this PayPal alternative is the best option you have.

Dwolla is very similar to PayPal whose expertise lies in Automated Clearing House (ACH) payments and bank transfers.

It provides an API that has branding tools that allow you to make branding of your checkout experience.

These tools are simple to use, understand and integrate.

However, it is only available in the USA not recommend for those looking for global payments.

Pricing:

The starting plan has no monthly fee it charges 0.5% per transaction at a minimum charge of $0.05 and the maximum charge of $5. (Check out their other plans here)

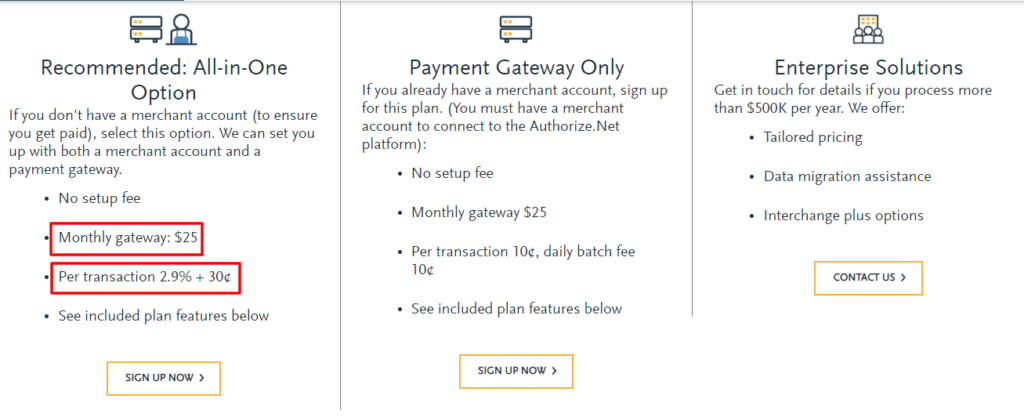

5. Authorize.Net

Authorize.net a subsidiary of Visa might not sound a bankable name but it has managed to gain the trust of merchants to conduct a secure payment process.

USA, Canada, UK, Australia, and Europe based merchants can easily conduct a transaction via credit/debit cards, Visa Checkout and other payment alternatives (e.g. PayPal, Apple Pay).

In addition, it provides a free 24/7 user support service with real people.

Its Mobile App allows you to receive and send in-app payments and it also provides number of tools that help to generate reports of account and sales.

Authorize.net Pricing:

The Pricing plans start from $25/month fee along with 2.9% + $0.30 per transaction.

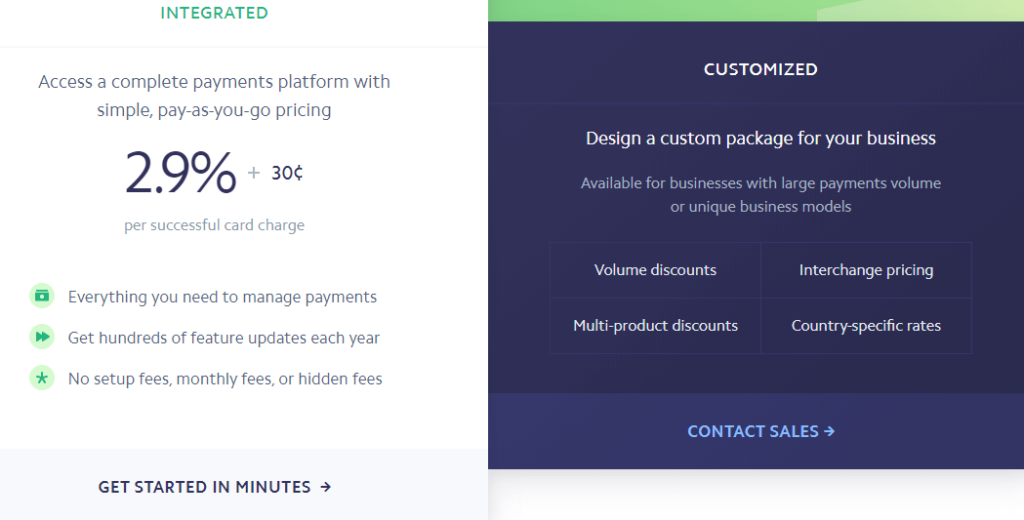

6. Stripe

Stripe is one of the most popular and suitable PayPal alternatives that specializes in online business. Even some ecommerce platforms mentioned Stripe as their primary payment option (e.g. Shopify).

Stripe takes care of everything in an online transaction from receiving the payments from customers to transfer it to the bank accounts.

The simple integration and customization in the payment system through Stripe’s API makes it preferred payment option among many businesses.

Stripe Pricing:

It charges 2.9% + $0.3 per transaction. You can also make a customized plan as your requirement.

Also, there are different prices for international, local, credit card, debit card and payment for large transactions. Check out the details here.

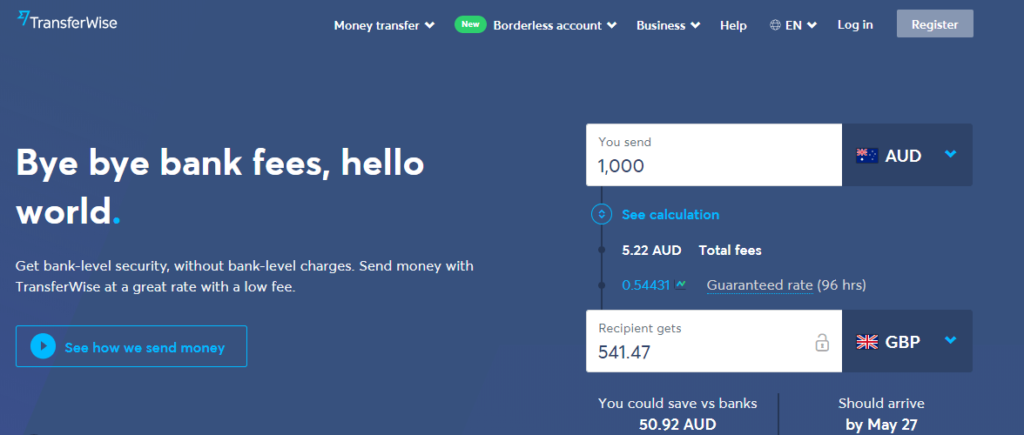

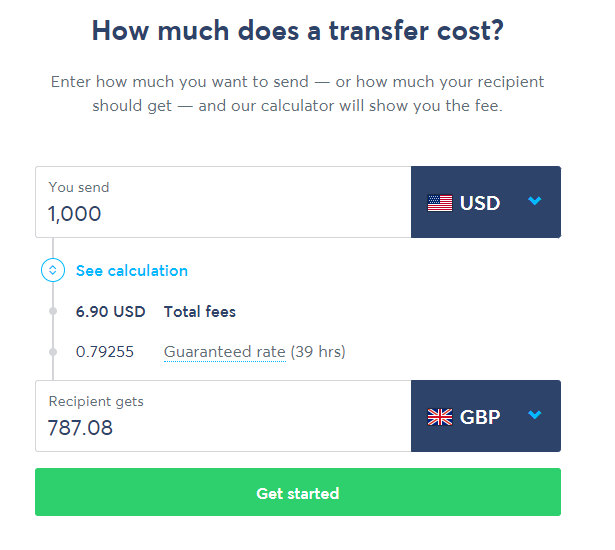

7. TransferWise

Transferwise claims that it is a cheaper way to make international transactions; it is a great PayPal alternative for global payments.

Its global reach helps the freelancer and online business to receive and send payments without any restrictions with minimum charges.

The borderless account of Transferwise provides debit cards that open the options for users to manage their money in more than 40 currencies. That allows the user to generate the invoice in the customer’s currency.

Transferwise Pricing:

Pricing depends on currency exchange. The standard charges are 0.6% + $1 per transaction.

You can calculate the fee here.

8. Square

Square is a unique PayPal alternative that allows the user to handle the payroll services with its point-of-sales service. The user can accept payments via debit/credit cards, cash, and checks.

It also offers invoicing, recurring payments, inventory management reports, and tools for payroll.

Square can easily integrate with the ecommerce store that accepts online payments with simple checkout options

Square Pricing:

The standard Price starts at 2.6 % + $0.10 per transaction. (Check out other Pricing plans here)

9. Brain Tree

Braintree is a PayPal service that is most suitable for large businesses and corporations, an expert in ecommerce payment via web and mobile.

It allows to receive and sent payment in more 130 currencies and operational in 45+ countries.

It also offers some features that large organization highly prefers including credit card storage, recurring bills and accepts online credit card payments globally.

As it is PayPal’s service, it integrates well with PayPal as well as with other significant payment providers such as Google Pay and Apple Pay.

Braintree Pricing:

There is no monthly fee of Braintree; its standard charges are 2.9% + $0.3 per transaction.

It also offers other customize Pricing plans you can check about it here.

10. Intuit – Quickbooks

Intuit is a perfect PayPal alternative for small-sized businesses and freelancers to ease their finance functions.

Apart from receiving payments from the customer, it also helps the business in making payroll for employees and calculates estimate taxes with their Quickbooks payments.

It provides that allows you to set up recurring billing, create an invoice, receives payments via mobile card and ACH bank transfers.

By integrating Quickbooks to the bank account, you can get automated generated accounting reports that eliminate the need manual data entry process.

Intuit Pricing:

The prices are not fixed, it charges 1% on the bank transfers. You can check the prices here.

11. Google Pay

Google Pay is another credible PayPal alternative that allows storing your debit/credit card information in your Google account so you can conduct fast, convenient and safe transactions from anywhere in the globe.

The primary feature of sending money is via smartphone however, you can pay online as well as in person.

Google Wallet service is free for customers and business transaction. Isn’t it great?

Google Pay Pricing:

Only credit card payment has charges that are 2.9% per transaction.

12. Amazon Pay

Amazon pay gets the major advantage from the credibility of its name that gains the customer confidence instantly.

You can easily use this payment platform by just simply login from the user account where the user is information is stored that makes the fast, smooth and safe.

Amazon Pay works on all devices Android as well as iOS, which allows the users to make payments from anywhere in the world.

Pricing:

The domestic transaction fee is 2.9% + $0.30 and cross border transaction fee is 3.9% + $0.30. (Get the details of Pricing here)

13. Venmo

Venmo is a digital wallet that is owned by PayPal.

Venmo is social, famous and easy-to-use payment platforms that especially use to send and receive cash in social circle.

To use it you have to make a list of people to whom you want to do the transactions by adding the money in your Venmo account or by linking your bank account.

Although Venmo seems to a payment platform for personal use, still numbers of people use it for business transactions. It has recently introduced a Venmo card service that allows the user to get access to their Venmo account with the card and use it for purchase.

Pricing:

Venmo is free to use, the only transaction is applicable on the credit card payment that is 3%.

Best PayPal Alternatives for Startup and Small Businesses

Although, PayPal is considered as the best payment provider option but for some newbie entrepreneur it is sometimes out of their access and for some it is not a favorable options.

No matter what your issue is there is always a second option. I am listing some of the best startup options for PayPal alternatives whose detail you can read and select the best option as per your need.

- 2CheckOut

- Payoneer

- Stripe

- Intuit

- Authorize.Net

- Transferwise

Best PayPal Alternatives for Amazon

“Can I use PayPal on Amazon?” a bunch of dropshippers and ecommerce entrepreneur have a similar question regarding Amazon and PayPal.

The simple and precise answer to this question is NO!

Amazon does not accept PayPal, at least not as a direct payment option.

However, on the PayPal community, several people have tried to answer this question that you can check out here.

Well, PayPal became a part of eBay in 2002, which is a direct competitor of Amazon. That is the major reason for Amazon not accepting PayPal as a payment option.

I recommend to rather finding the answer to ‘how can I use PayPal on Amazon’ you had better find the best PayPal alternative for Amazon.

And what could be the better payment than Amazon’s own payment AMAZON PAY.

Although you have multiple other alternatives but as far as the best alternative of Amazon is a concern, Amazon Pay wins the race.

Best PayPal Alternatives for Aliexpress

Use of PayPal on Aliexpress is a dilemma; can you use PayPal on Aliexpress? Stills many online sellers are confused about it.

Well, the simple answer is yes you can but on some suppliers.

However, for the rest of the supplier, there are some PayPal alternatives for Aliexpress that you can use but those alternatives are not the one that I have mentioned above yet they are trustworthy.

Here is the list of PayPal alternative on Aliexpress.

- VISA

- MasterCard

- Maestro

- American Express

- QIWI Wallet

- WebMoney

- Western Union

- GiroPay

- Plus, 7 more global payment services

- Alipay

Wrapping Up

For all the online sellers out there and those who are willing to be one – I am certain this post in all way or at least somewhat comes handy for you in the hunt of finding the best PayPal alternative in 2019.

I know there are number of payment providers available in out there that is being used by millions of user.

So, if you have any suggestion regarding the above mentioned and non-mentioned PayPal alternative feel free to share your opinion in the comments below.