Drop Shipping in Canada – A Brief Guide for Canadian Online Sellers

- Apr-26-2019

- Ameer Rizvi

- 21 comments

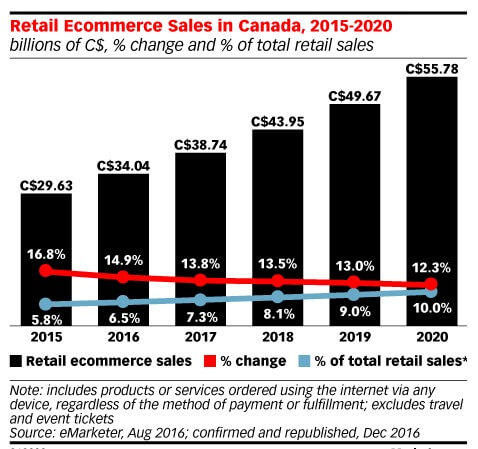

Canadian eCommerce numbers coming out in 2016 and 2017 are not just attractive, they are astonishing. The country’s online shopping industry and local market present great opportunities for drop shipping canada business. More online shoppers, constant innovation, and an increasing number of drop ship suppliers has allowed Canadian eCommerce to evolve rapidly.

According to a research from Canada Post, 80% Canadians shopped online in 2016. eMarketer Retail report that online retail sales in Canada grew by 14.9% in 2016, from $29.63 (CAD) billion in 2015 to a resounding $34.04 (CAD) billion in 2016. In their 6 year trend eMarketer projects that retail sales will reach an estimated $40 billion by the end of 2017.

Similarly, Forrester Research has predicted that Canadian online retail sales will account for 10

- 56% of Canadians want to support local businesses and the local economy

According to a PayPal report in 2016, there are massive opportunities to start a business of drop shipping in Canada:

- 51% want to avoid the cost of international shipping, taxes and duty

- 44% cite the Canadian dollar exchange rate

- 32% prefer goods that are made in Canada

Why start drop shipping business in Canada

It is the ideal time to launch your own best drop shipping business in Canada. Canada Post reports that:

- A staggering 83% Canadian online buyers bought products online from US online retailers

- 42% bought from China & the Pacific Rim

- 16% purchased from European e-retailers

A large chunk of online buyers is already purchasing online from the USA, Europe, China and other parts of the world. This gives drop shipping businesses a great opportunity to tap up a market of between 15 – 18 million online buyers. Considering the strong intent to buy from Canada based e-retailers and buying Canadian manufactured goods, there is immense potential for drop shipping businesses in Canada. Another crucial statistic from Canada Post identifies the diversity in shopping habits of Canadian online shoppers. There is an enormous opportunity for Canada dropshipping businesses in 11 product categories.

Considering the strong intent to buy from Canada based e-retailers and buying Canadian manufactured goods, there is immense potential for drop shipping businesses in Canada. Another crucial statistic from Canada Post identifies the diversity in shopping habits of Canadian online shoppers. There is an enormous opportunity for Canada dropshipping businesses in 11 product categories.

How to Start Drop shipping Business in Canada

Setting up a drop shipping business in Canada is quite simple, like all other countries. I have already done articles on creating drop shipping businesses, so you can look through them for in-depth reading. The process of launching a dropshipping business in Canada may slightly different compared to other countries but is more or less the same.

Below is a stepwise guide to launch a drop shipping business in Canada:

- Register a domain for your e-store – NameCheap, GoDaddy, Hover, 1&1, Web.com

- Research which products you wish to sell and the target audience

- Find dropshipping suppliers for your e-store

- Paid service like SaleHoo & Oberlo provide direct contact with suppliers

- You can also try the Canadian Importers Database

- American suppliers from ThomasNet

- Also try WorldWideBrands and Wholesale2B

- Choose an eCommerce Platform to design & launch the e-store – Shopify, BigCommerce, WooCommerce, Volusion etc.

- Import products to your eCommerce store – Oberlo, Dropified etc.

- Market the eCommerce store

I highly recommend all interested entrepreneurs to read through the guides provided above. I specifically wrote the articles to assist beginners who are just starting out with eCommerce. The articles provide easy access to supplier search, product search, building your online store, and marketing your drop shipping business to both Canadian and international audiences.

Designing and launching an e-store is fairly easy, requiring no more than 48 hours. A great way to start with a small drop shipping business is with Ali Express. However, you can always choose suppliers from within Canada for faster delivery. The real test is though is finding the right dropshipping products to sell and finding the right suppliers to source dropshipping from. Once we are through that, then comes the part with the most effort. Our dropshipping guide will come in handy.

In the final step, you are required to market your products & e-store brand through various channels. This can be emailed, paid ads, Facebook marketing, communities & forums and many other digital marketing channels. Once you have a steady stream of traffic coming into your e-store, it’s probably time to think about running promotions and special events.

Wholesale Distributors in Canada

Finding suppliers is probably the most difficult part of setting up your drop shipping business in Canada. But, the most promising aspect is that there are multiple Canadian drop shipping companies ready to source products to e-stores. eCommerce support platform CanadasInternet, published top ranking Canadian dropshippers and dropship suppliers Canada (by product) from Canada’s dropshippers directory:

Hudson’s Bay Company is one of the oldest dropshippers in Canada and drop shipping wholesalers in the World. They started by offering pelts and now they are selling almost everything at wholesale prices. They have a number of stores and vendors under their brand name ranging from luxury to premium department stores selling a wide variety of items and products.

Lululemon Athletica is one of the best clothing wholesalers in the Canadian market. They thrive upon their high-quality fabric and their construction technology for dropshipping to Canada. Lululemon offers the highest grade fabric for men, women, and children. They offer everything clothing from tank tops to undergarments.

If you have been looking for some great eyewear then Coastal Contact is the way to go. It’s one of the top wholesalers in Canada for everything eyewear. From glasses to contacts, it offers everything that provides your eyes with the protection they need. Your perfect vision needs are fulfilled at Coastal Contacts.

The Shopping Channel is the perfect place to buy anything and everything. It’s another top wholesaler available in Canada that offers a wide range of products. With over 20 different categories available, The Shopping Channel has the largest product catalog. No matter what niche you are in, you will find almost everything you need on this retailer.

BuildDirect provides high-quality home improvement and home building products at manufacturer prices. These are all high-quality home improvement accessories. If you have a store where you sell home improvement items then BuildDirect is the perfect Canadian wholesaler to source your products from. They offer reasonable prices and high-quality items with a short lead time.

Beyond The Rack is a unique wholesaler in Canada that provides high-quality designed items at highly discounted rates. Men and Women can find designer brands at 80% off of the original price tag. If you sell such luxury items then this is the perfect place to source such items from. You can make great profits selling such luxury items while buying these at almost half their original price.

Looking for the best furniture and decor for your office or home? Well, Cymax is the perfect place to buy these. If you have a furniture store or you sell office decor then Cymax is the best wholesaler in Canada to source these products from. You can buy the best products constructed with high-quality materials. They sell everything from office decor, restaurant, home, and other categories.

If you are selling books for adults and/or Children then Indigo Books is the great place where you can source your products from. They also sell other items like electronics and accessories so even if you have a different store category, you can still source your products from them. However, it’s the perfect wholesaler for books, so if you are running an online bookstore, you should definitely source the books from Indigo books.

MEC offers a wide range of products ranging from clothing to mountain bikes. If you are selling such products then you will be amazed to find their catalog at reasonable prices. They also offer great camping and hiking accessories that are of highest quality. If you are looking to sell such items then sourcing the products from MEC is a great option for you.

If you are running a computer store then you are going to love the product catalog offered by Softchoice. They offer a wide range of computing accessories and peripherals. From cables to routers/modems, everything computing is offered at Softchoice. Even if you are targeting an individual computing segment like Networking, etc, you can still avail great prices on a wide range of networking peripherals.

Reitman’s offers a wide range of clothing for women. Everything from athleisure to traditional dresses is offered in their product catalog. They offer high-quality fabric and reasonable prices so you can directly source your products from them if you are into the women apparel niche. They offer great wholesaling rates for vendors so you can make a hefty profit on each product.

Indochino is all about men’s luxury clothing. From high-end suits to tuxedos, Indochino provides everything that a man needs. If you are selling high-quality men’s clothing then Indochino is definitely a wholesaler you should look into. Their wide range of classic and trendy clothing and accessories is unrivaled. It can provide you a great edge over your competition in terms of both price and quality.

Aldo wants to share their brands and expertise with other retailers through their wholesales program. They thrive upon selling the best footwear and accessories to their vendors on highly reasonable prices. They provide numerous different product from luxury footwear to casual slippers. Aldo is one of the best wholesale distributors in Canada.

Although the above is possibly the best dropshipping companies in Canada, you can also have a look at other brilliant wholesale distributors learn how to start a drop shipping business in Canada. These include:

Dropshipping in Canada Taxes & Duties

Tax for dropshipping business in Canada applies to both imports & exports. There are certain products exempt from taxes, so you will have to research and confirm that your product pricing complies with Canadian tax laws.

Canadian Dropshipping Businesses Importing Goods to Canada

Dropshipping businesses in Canada that work with AliExpress or other international dropshipping suppliers must go through a proper process. To make it easy, I have explained the process, as detailed by the Canadian Border Services, step by step:

- Obtain a Business Number

Before importing goods into Canada, dropshipping businesses need to register a Business Number from the Canadian Revenue Agency (CRA). The process is the same for both individuals and businesses, and requires no more than a few hours to acquire a Business Number.

You can simply fill out the online form from the Canadian Revenue Agency and submit it online. In addition, you can also call the CRA on their helpline 1-800-959-5525.

- Identify the goods you wish to import

Dropshippers must provide complete details, shipping requirements, and descriptions of the products they will import. This information is used in the Tariff Classification process, which determines the exact tax rate for a certain product class.

- Consider using the services of a licensed Customs Broker

If you are savvy with trade & financial documentation it’s just a perfect scenario. However, hiring the services of a licensed customs broker makes the process much easier. The broker acts as your agent and interacts with the Canada Border Services Agency (CBSA). Do remember here though, you will be eventually responsible for accounting documentation, payment of duties & taxes, and consequent changes.

According to the CBSA website, the broker’s services include:

- Obtaining the release of imported goods;

- Paying duties that may apply;

- Obtaining, preparing and presenting or transmitting the necessary documents or data;

- Maintaining records; and

- Responding to any CBSA concerns after payment.

- Determine country of origin for the goods imported

It is necessary to document where you products are manufactured, where they ship from, and where individual parts for the products are produced & assembled. The CBSA provides complete requirements for proof of origin here.

- Ensure good imported are permitted in Canada

Do keep in mind that some products are simply not permitted within Canada and are immediately seized. There is a proper classification of products and provides complete details of good prohibited within the country. Browse through the official prohibited documents rules from the CBSA.

- Determine whether products are subject to any permits, restrictions or regulations by the Canadian Government

Certain products will require permits and have regulations placed on their import. If you are dropshipping such items always ensure you have declared such items to the CBSA. The official documentation for permits, restrictions and regulations are listed below:

- Reference list for importers

- Acts & Regulations for Government Departments

- Special Import Measures Act

- Determine the 10-digit tariff classification number for each product you are importing.

The tariff classification number and country of origin determine the rate that will be applied to your products. For more information on how Canadian agencies classify products I have attached official documentation.

- Determine the applicable tariff treatment and rate of duty

Once the Tariff Classification is complete, you must determine the rate of duty that will apply to your imported goods, check & confirm from the Custom Tariff Schedule.

- Determine if your goods are subject to the goods and services tax (GST), excise tax or excise duty.

After all the compliance and classification of goods, you must determine if imported products require the levy of GST (Good and Services Tax). Usually a flat 5% GST rate applies to most goods, but there are certain products that are exempt from GST. These include prescription drugs, medical and assistive devices, basic groceries, agriculture and fishing goods.

It is recommended to contact the Canada Revenue Agency for hands on support with dropshipping taxes. Canada based dropshipping businesses can also have a look at the Excise Tax Act document.

While the steps mentioned above remain essential, there are 10 more steps to determine the drop shipping taxes and duties for dropshipping imports. As a personal recommendation, I advise using the services of a Customs Broker. They will advise better, and have most of the process on their fingertips to support your dropshipping business.

Determining Sales Tax on Dropshipping Products in Canada

Apart from duties, all goods being sold in Canada are required to pay sales tax. This is another very complex and confusing stage for any dropshipping business in Canada. There are 3 kinds of tax levied on products sold within Canada:

- GST – General Sales Tax

- PST – Provincial Sales Tax

- HST – GST + PST

Sales tax requirements also differ from province to province in Canada. You will pay the taxes for the region your business is registered in, for the complete schedule have a look at this excellent guide form CanadaBusiness, if you are starting a dropshipping business in Canada.

Payment Gateways in Canada

One of the reasons that made Canada the best market for dropshipping is its various payment gateways.

Here is the list of payment gateways in Canada.

- 2Checkout

- Alipay Global

- Authorize.net

- Beanstream

- BitPay

- Chase Paymentech (Orbital)

- Coinbase

- CyberSource

- E-xact

- Elavon Converge

- First Data Payeezy

- FuturePay

- G2A Pay

- GoCoin

- IATS Payments

- Ignite Payments

- LAY-BUY Powered by PayPal

- Moneris

- MultiSafepay

- NETbilling

- Network Merchants (NMI)

- Optimal Payments

- PayPal Express Checkout

- PayPal Payflow Pro

- PayPal Website Payments Pro (CA)

- Psigate

- Sage Payment Solutions

- Shopify Payments

- Vantiv Integrated Payments

Dropshipping from China to Canada

It’s a great prospect dropshipping from China to Canada, through AliExpress. It’s easier to setup and start selling quickly. However, Canadian import laws are quite strict and based on their requirements it’s not a favorable prospect.

You can, however, jump right in with the help of a Customs Broker. This depends if you can actually afford the cost when starting out to import goods. Unfortunately, there is not much of a choice but AliExpress when dropshipping from China to Canada. To launch your own eCommerce dropshipping business from China to Canada, read through our beginners guide.

There are great advantages for dropshipping from China to Canada:

- Low cost products sourced directly from China

- A wide variety of suppliers to source from

- No import restrictions and duties on exports in China

- Low cost setup without huge capital investments

- Easy to setup using AliExpress & AliBaba

Don’t get me wrong though, there are some areas of concern that you will have to consider before dropshipping from China to Canada. These include

- Higher cost of delivery

- Import restrictions

- Increased tax costs on imports

- No Quality Assurance provided by Chinese suppliers

- Copyright infringement due to prevailing laws in Canada

List of Companies Offer Dropshipping for Their Products to Canada

Multiple companies are offering dropshipping for their product to Canadian sellers. Here is the list of the companies:

Dreamhug – Weighted blankets in Ontario available for dropshipping.

Printful – Order custom design products to dropship or sell direct online under your own brand. Sell from your website, including all major eCommerce platforms like Amazon.

Vitabase Health Supplements – Vitamins and supplements with global shipping.

Fragrance Net – Offers discounted brand name fragrances, skincare and hair care products.

Olive Kids Canada – Decor and bedding for kids. They drop ship across Canada from Ontario.

Grosche – Kitchenware company offers drop shipping in both Canada and the US, along with wholesale options.

Wordans – Canadian clothing wholesaler specializing in t-shirts, tank tops, sweatshirts, jackets, hats, work clothes, accessories, etc.

Nu-Look Fashions – Canadian Fashion wholesaler offering wholesale clothing, including knitwear, formal wear, office wear, sportswear, cruise/resort wear, and evening wear.

XTek Electronics – Offers to dropship the electronics in Canada.

Wedding Star – Almost 3000 wedding accessories can be drop shipped to Canada and they pay the duty charges

To contact the companies check out Canada Trade Index.

Dropshipping Risks

Dropshipping business is famous for its lower risk, easy to start and higher profit rates. Nonetheless, to scale up your dropshipping business and maintain a steady growth there are some risks that you must consider.

In the dropshipping model, supplier plays a major part in the growth and decline of your business. That is why the risk is also related to the supplier.

The two major risks included;

- Supplier back off halfway through the business

- Supplier went out of stock while you receive the order from the customer.

To avoid the encounter with these situations, make sure to build up a strong relationship with your suppliers and gain trust to get the products in any scenario.

Look out for verified suppliers on Aliexpress and at least supplier with good rating who have completed good number of orders.

Always keep more than one supplier in your list who offers a similar kind of product to ensure the continuous supply of products.

See You Again Soon

Canada has the most lucrative future in the dropshipping industry. So, it’s a great opportunity to start a dropshipping business in Canada. Double digit growth, local wholesale dropshipping suppliers, and an abundance of buyers all lead to the conclusion that Canada dropshipping business will prosper in coming years.

If you have any further questions or would like me to add something to the guide, just drop a comment below. DO remember to join our brilliant community of eCommerce experts and sign up to our monthly newsletter. Until next time, see you again soon!

How to Chargeback on PayPal to Get Your Money Back

How to Chargeback on PayPal to Get Your Money Back  What to Sell on Etsy –12 Best Selling Items on Etsy in 2021

What to Sell on Etsy –12 Best Selling Items on Etsy in 2021  11 Easy Ways to Make Money on Amazon in 2021

11 Easy Ways to Make Money on Amazon in 2021  eBay Dropshipping – Learn Dropshipping on eBay in 5 Steps

eBay Dropshipping – Learn Dropshipping on eBay in 5 Steps

Hi, i live in canada and i am planning to start a drop shipping business in canada by using canadian manufacturers. I am still on the planning phase and it be really helpful if i could talk to you regarding the whole process.Please let me know how can i reach u. Thanks 🙂

You are welcome to join our Facebook community and share your thoughts there.

https://www.facebook.com/groups/shopify.tips.help/

Hello, i still cannot find a solid answer regarding if I am a Canadian ecommerce website that only ships to USA, am i required to pay USA sales tax? All my products come from China and I hold no inventory in USA.

I understand that it depends if you have nexus or if the drop shipper has nexus. But what if nexus doesn’t apply? Do i charge taxes if my customers are ordering from the US? I cannot find anything about this anywhere. Everyone keeps answering in a round about way. Please help!!

According to Nexus Economics, if you make a certain amount of sales in a US state then you are bound to pay sales tax decided by a state. There is a threshold of an average $100,000/year, if you exceed it then you have to comply with the sales tax of the states in which you are selling.

i just discovered your blog and i’m already in love! Thank you for posting so many helpful articles, especially this one which helps break down popular brands that we can trust. I just started working at Sephora so I’m still learning everything in the industry, and this article has made me much more knowledgeable!

Such a great article I have ever seen. Everyone should follow your thoughts. I really appreciate it.

Such a great article I have ever seen. Everyone should follow your thoughts. I really appreciate it.

I simply adored your method for the introduction. I delighted in understanding this. Thanks for sharing and continue composing. It is great to peruse websites like this. As always, we welcome yourself affirmation and acknowledge as valid inside

The information about Wholesale Distributor in Canada is wrong. Lululemon Athletica does not offer dropshipping for online sellers.

According to the market, most Canadian online buyers bought products online from US online retailers. If so, is it a good choice to sell as a canadian dropshipping retailer?

I have been preparing to open my first new e-commerce through Spotify and Oberlo, but i am now facing tax issues since I have no clue in reporting which to where.

My major suppliers will be from China. However, my future customers will not be limited to Canadians, but extends globally where anyone in this world.

The base of my drop shipping will be in Canada, but trading will happen btwn China and some other countries. I am for sure subjected to pay income taxes.. at least, but i am not sure what types of taxes i am responsible to. Could I get an advise for my situation? I guess my case is not rare.. but i cannot find a clue..

Hey Chloe,

Did you end up finding an answer to this?

Hi, Thank you for providing the information, i have one question regarding drop shipping store in Canada that uses Aliexpress but has orders to be dropshipped from China to U.S, is there a tax on the dropshipper by Canadian tax law?

Id love for someone to contact me.

From Ontario, Canada and would like to open a Shopify account and start drop shipping. Making my own store to sell products and services.

Id love to speak with someone perosnally or email.

if you are doing this from Canada already id love to talk … get advise and assistance and questions regarding taxes come income tax time. Thanks!

Eva

My email: dolphinstr@hotmail.com

I am a Quebec registered online retailer. If I use a U.S. manufacturer for dropshipping, and I sell a product to a customer in, lets say Ontario for this example…Do I charge them sales tax on the purchase?

Right now 100% of my inventory is owned by me, and ships from Quebec, so taxes have been easy and without question. However, I want to expand my offerings, and this dropshipping sounds like a great option.

In this scenario we have my Quebec store, an Ontario shipping address, and a package coming from the U.S.

CBSA might levy duty on the package. Would that duty be waived if I asked the U.S. dropshipper to include my store invoice, showing they already paid Ontatrio sales tax?

You have to pay the taxes yourself. You don’t get any duties levied, so you better reach out to the CBSA and confirm any details regarding the sales tax. Mostly, you will have to pay the taxes as you did before because an international supplier doesn’t change anything for you.

Thanks for the tip…and great timing because I needed to drive across the border after I read your message, and asked a CBSA officer face to face when I came back in 🙂

Short answer: For now I do not need to charge ANYONE in Canada sale tax, on items shipped from within Canada, or items coming in from another country, because of some rule about $30,000 in worldwide sales.

I need to research that somemore, as there was a line behind me, but the CBSA officer seemed absolutely certain in their statement. I am hoping they are correct..but at the same time hoping that I have enough sales within Canada, after I reach that 30k (if that rule exists) that I need to start charging.

Curious, what is the packaging like with drop shippers like Beyond the Rack and Indigo? When the product is delivered to the customer, does the box reveal what store it came from? Is any paperwork included, showing the drop shipping cost? I’m figuring drop shippers prefer less info on where they drop shipped from to keep things kosher?

These are the kinks that you need to iron out when making a deal with the supplier. Most of the times, suppliers are quite accommodating when it comes to white labelling. They would put your brand name and logo on the packaging, however, if that’snot possible then at the very least, they will make it all blank and not show anything that would make it look like dropshipped.

If I am a Canadian ecommerce website that only ships to USA, am i required to pay USA sales tax? All my products come from China and I hold no inventory in USA.

I have researched this within the last few months, so my info should be up to date. You only need to remit U.S. sale tax to U.S. states that you have an established Nexus in.

There are several ways you could have established a Nexus, but most of them are unlikely to occur, but still look up the definition to be safe.

As a dropshipper, the most common way to establish a Nexus in a U.S. state, when using a Chinese dropshipper is if that Chinese company ships the item from a warehouse inside the U.S. In that situation you would need to remit sales tax to that U.S. state.

The exception to this is if that state has an established Sales Tax Threshold that applies to eCommerce.

Each of the 50 states have the ability to make their own rules. You can either research all 50 states now, but that is a waste of time, or you can wait until one of your Chinese companies ships something from a U.S. state, then research to learn of they have a Sales Tax Threshold.

Good luck..and don’t sell the same things as me..selling online is hard enough without MORE competition 😉